Outlook for End of 2022, 2025, and 2030

[ad_1]

Bitcoin Price Prediction: BTC adoption is still a dominant trend in Australia, where 61% of crypto owners hold BTC. This represents the largest share of global Bitcoin ownership. The exponential rate of adoption of blockchain technology has led an expert panel to believe that the BTC price could reach $79,000 by 2025.

Rome wasn’t built in a day. Instead, the workers were laying bricks every hour, multiplied by years, even decades, of sweat and blood.

Now that I have your attention, let’s explore the crypto angle. You are reading this because of your enthusiasm toward crypto (punches the air). But using the Rome analogy here – global cryptocurrency adoption will take a while.

Despite significant recent setbacks, crypto adoption rate scenario might surprise you. So, here’s to keeping the ‘Crypto’ Christmas spirit alive.

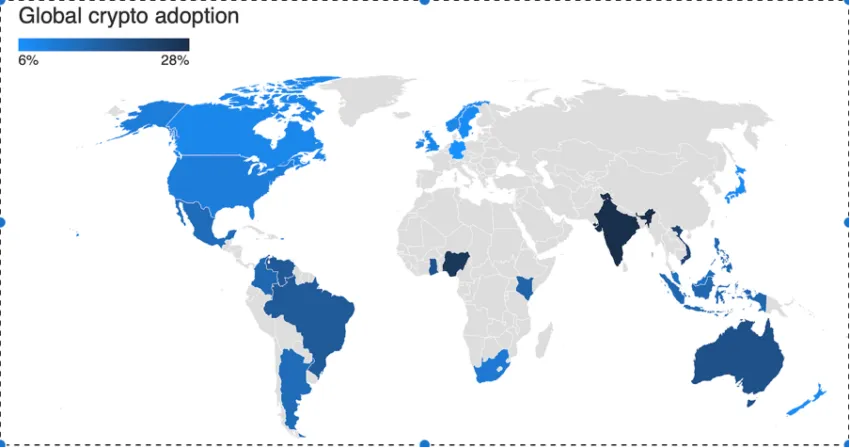

A comparison web portal, Finder’s Cryptocurrency index, measured the growth of cryptos globally based on a survey of internet users in 26 countries.

Herein, India led the charge with 28% ownership, followed by Nigeria with a 26% global adoption rate. Australia ranked 5th with a 20% share after Vietnam (23%) and Hong Kong (21%), respectively.

But is Australia in-line with becoming a Bitcoin country? Here’s the what, why, and how…

Down Under in the Aussieland

Entities or individuals buying or selling Bitcoin have weathered everything: from rain to sunshine. But have placed their faith in countries using cryptos as a store of value. In this case, it seems to be Australia.

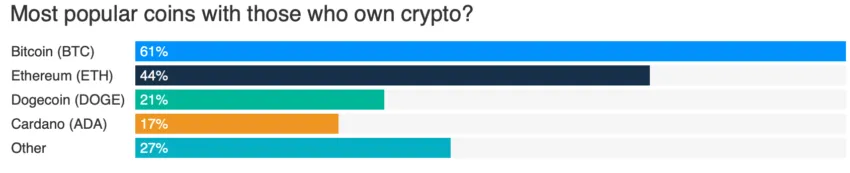

An October 2022 report from Finder puts Australia in the spotlight among 26 nations that were surveyed about crypto adoption. In terms of cryptos, Bitcoin (BTC) is the most preferred crypto, followed by Ethereum (ETH) and Dogecoin (DOGE).

As per the report, 61% of Australian crypto owners own Bitcoin. Whereas the global average BTC holders stood at 36%. Ergo, Australia is way above, probably seconding the narrative of being called a Bitcoin country.

After Australia, Ghana took the 2nd spot with a 58% share, followed by Nigeria with 48%. At the other end is Mexico, where 22% of crypto owners say they own Bitcoin.

Demographics and Crypto Age Trends

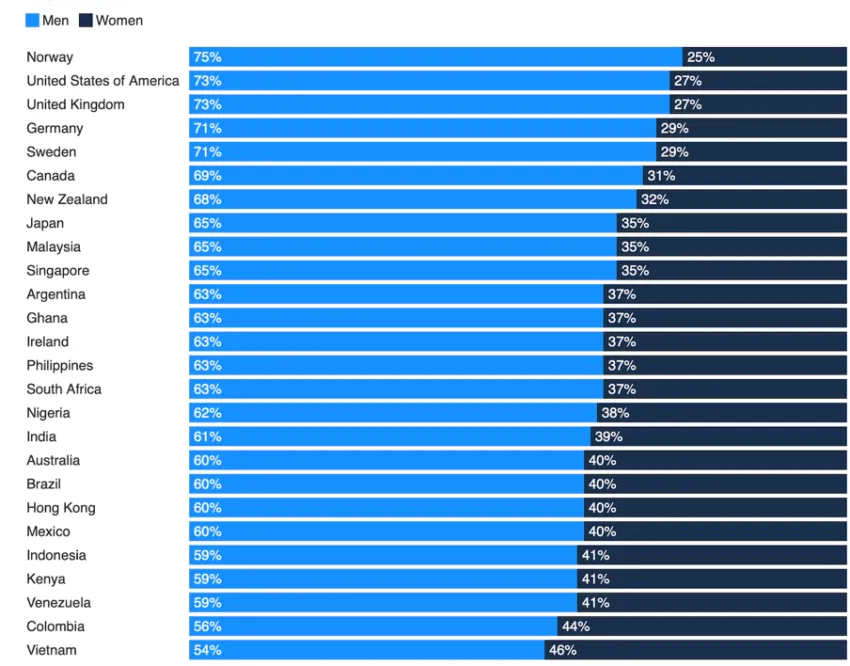

Among those surveyed in Australia, 60% were men, while 40% were women. There is a wide gap in crypto adoption between men and women. On average of crypto owners, the report added:

“(…) an average of 36% are women compared to 64% are men. Norway has the widest gap, with 75% of people that own crypto being men. Vietnam is the closest between the sexes (crypto ownership being 54% men, compared to 46% women).”

Here’s the table that showcases the age trends:

Bitcoin Price Prediction: Short-Term and Long-Term Route

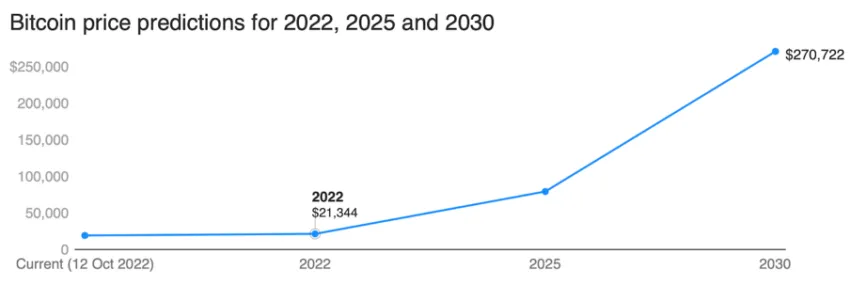

Now comes the fun part for crypto enthusiasts out there. Finder’s October survey also shows BTC price predictions for the short- and long-term future.

Herein 55 industry (fintech/crypto) specialists were surveyed on how Bitcoin price would perform over the next decade. Here are some exciting results, measured on an average rate:

“Our panel thinks Bitcoin (BTC) will be worth $21,344 by the end of 2022 before rising to $79,193 by 2025.”

Meanwhile, Bitcoin price could reach $270,722 in 2030, per the graph below.

A Bitcoin price prediction around the $21,000 mark – certainly not the stuff dreams were made of, but given the intense bearish obstacles, one might readily take it up.

But remember, Bitcoin price could find yet another bottom in this bear market. Something that was wisely taken up within this survey. I.e., at its highest, the panel ‘sees BTC reaching $24,013 in 2022, but it also predicts a bottoming-out to just $15,283 at some point this year.’

The crypto crash played a significant role in the speculative scenario(s).

One of the panelists and the CEO of EXMO, Serhii Zhdanov, stated:

“Nothing fundamentally has changed for Bitcoin, it’s a global capital crisis, and Bitcoin is affected in the short term but will recover; a lot of other financial assets will not.”

Is BTC Still Considered a Store of Value?

Absolutely YES! A majority believes in BTC ability. 77% of the panelist voted in favor of BTC, whereas 19% said otherwise. The remainder of 4% were unsure.

In addition, 46% of the experts said Yes to buying Bitcoin, while 44% are HODLers. Meanwhile, 10% are sellers.

“The most common reason why our panelists think it’s time to buy BTC is because the current price weakness is due to the macroeconomic factors weighing it down rather than a fundamental change in the cryptocurrency.”

That said, Bitcoin remains a topic of scrutiny both inside and outside the crypto globe. Especially in Australia, given the regulatory uncertainty in this region and high inflation rates.

In a statement led by the government led by Prime Minister Anthony Albanese added, “As it stands, the crypto sector is largely unregulated, and we need to do some work to get the balance right so we can embrace new and innovative technologies.”

Given the crypto traction in Australia, the government took a serious approach toward passing a clear and transparent regulation. Until then, crypto regulation and handling crypto remain a grey zone.

This indeed could be seen by a recent interaction of crypto providers here. As BeinCrypto reported, three crypto exchange-traded funds (ETFs) introduced in Australia earlier this year were delisted.

Got something to say about this article or anything else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

[ad_2]

Source link